Cyber crime in the UK isn’t just frequent - it’s financially lopsided. A small number of incidents cause a very large amount of damage. Here’s what the top level UK cyber crime statistics actually say. In the 12 months leading up to 1 January 2026, there have been:

UK Cyber Crime Key Insights

- 239.6k cyber-enabled crime reports were made in the UK in 2025.

- £1.63b in reported financial losses.

- £6.8k was the average loss per report.

- Consumer fraud dominates reporting, with 94.1k reports and 39.3% of all cases.

- Cyber-dependent crimes (malware, hacking, account compromise) amount to 54.1k reports and 22.6% of all cases.

- Investment fraud is the real outlier with 23.3k reports (9.7%), £937.1m lost, 57.4% of all reported losses, and £40.3k average loss per case. Fewer than 1 in 10 reports account for well over half of all financial losses.

Individuals

- Individuals accounted for 222.4k reports (92.8% of all cases), £1.03b lost (62.8%), averaging £4.6k loss per report.

- Investment fraud alone covered 22.8k of individual reports (10.2%), £597m of individual financial losses (58.2%), and averaging £26.2k loss per individual victim.

- Consumer fraud had the highest number of reports (87k) and amounted to 24.2% of all financial losses (£248.3m) for individuals.

- Age doesn’t protect people, but it changes the risk - 30–39 year olds had the highest number of reports, 46.4k (20.9%).

- 60–69 year olds had the highest total losses (£203.3m), with £7.5k average loss per case.

- 90-99 year olds appear to be disproportionately hit hard when we look at the loss per report (£7.4k).

Organisations

- Organisations were clearly a higher target with £35.4k average loss per report from 17.2k reports (7.2% of cases) and £607.5m lost. That’s nearly 8× the financial impact per incident compared to individuals.

- Once again, Investment fraud, was the single most dangerous type of fraud for organisations, with 463 reports, £340.1m lost, and a whopping £734.6k average loss per incident.

- Among organisations reporting cyber-enabled crime, Limited companies averaged £57.9k loss per report. That's £538.0m (88.6%) of all losses and 9.3k (54.1%) all reports for organisations.

- For LLPs (Limited Liability Partnerships), the average loss per report was £34.9k and 0.7% of all reports and losses.

- PLCs had a lower average loss per report of £8.8k, but amounted to 4k (23.5%) of all reports and £35.7m (5.9%) of all financial losses for organisations.

- Charities had an average loss per report of £7.4k, with 501 of all reports (2.9%) and £3.7m (0.6%) of all financial losses for organisations.

- Sole traders amounted to 640 reports (3.7%), £4.3m of all financial losses for organisations, and £6.8k average loss per report.

UK Cyber Crime Statistics Breakdown

Crime Types

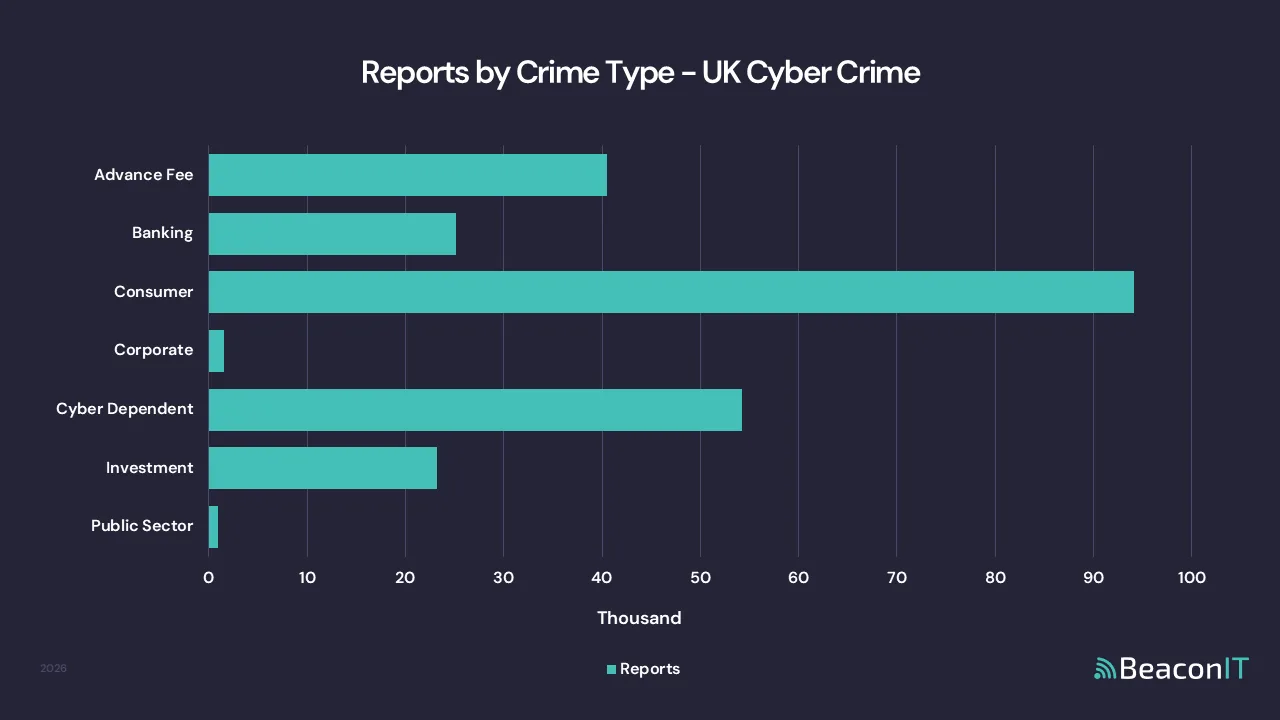

By report volume

| Crime Type | Reports | % |

| Advance Fee | 40.4k | 16.9% |

| Banking | 25.2k | 10.5% |

| Consumer | 94.1k | 39.3% |

| Corporate | 1.6k | 0.6% |

| Cyber Dependent | 54.2k | 22.6% |

| Investment | 23.3k | 9.7% |

| Public Sector | 892 | 0.4% |

Insights for Report Volume

- Volume does not equal severity - Consumer fraud accounts for the largest share of reports (39.3%), but high reporting volume masks the fact that most of these incidents are relatively low value individually.

- Cyber-dependent crime is common, but not financially dominant - Over 1 in 5 reports (22.6%) relate to malware, hacking, or account compromise, yet these incidents rarely drive significant financial loss on their own. Their impact is often operational rather than monetary.

- Advance fee fraud remains stubbornly persistent - Nearly 41,000 reports (16.9%) show that low-effort scams continue to succeed at scale, particularly where trust and urgency are exploited.

- Investment fraud is disproportionately dangerous - Fewer than 10% of reports relate to investment fraud, yet this category consistently signals higher-risk incidents that warrant closer attention.

- Corporate and public sector cases are under-reported, not low-risk - Together accounting for just 1% of reports, these categories appear small but this reflects reporting behaviour, not exposure or impact.

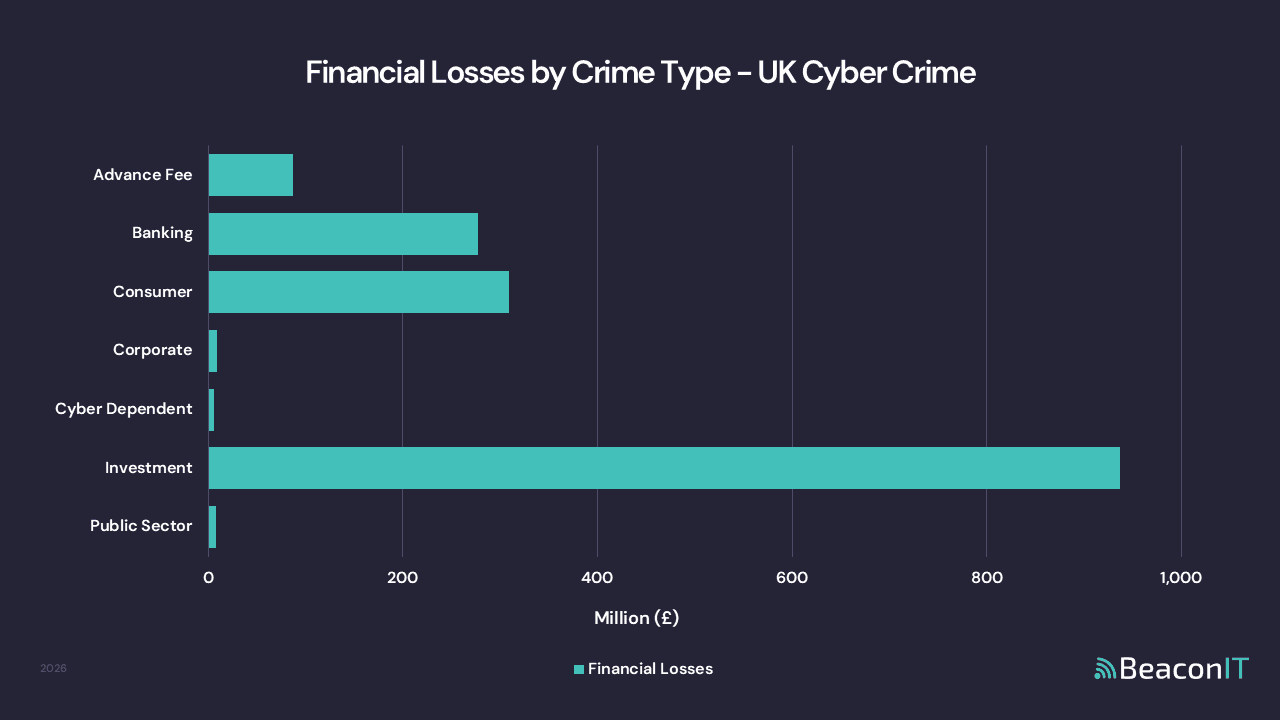

By financial losses

| Crime Type | Losses | % | Loss/Report |

| Advance Fee | £87m | 5.3% | £2.2k |

| Banking | £277.5m | 17.0% | £11k |

| Consumer | £308.9m | 18.9% | £3.3k |

| Corporate | £9.6m | 0.6% | £6.2k |

| Cyber Dependent | £5.6m | 0.3% | £103 |

| Investment | £937.1m | 57.4% | £40.3k |

| Public Sector | £8.1m | 0.5% | £9.1k |

Insights for Financial Losses

- Losses are heavily concentrated, not evenly spread - Investment fraud alone accounts for 57.4% of all reported financial losses, despite representing fewer than one in ten incidents.

- Average loss tells the real story - An average investment fraud loss of £40.3k per report highlights how a small number of successful attacks create outsized damage.

- Cyber-dependent crime is disruptive, not lucrative for attackers - Despite its visibility, cyber-dependent crime contributes just 0.3% of total losses, with an average loss per report of £103. Reinforcing that financial harm usually comes later via fraud.

- Banking and consumer fraud quietly drain large sums - Together, these two categories account for over £586m in losses, driven by scale rather than single catastrophic events.

- Public sector and corporate losses appear modest but risk is asymmetric - While their total losses are comparatively low, the potential impact of a single successful incident remains high due to operational and reputational consequences.

UK Cyber Crime Statistics for Individuals

Crime Types

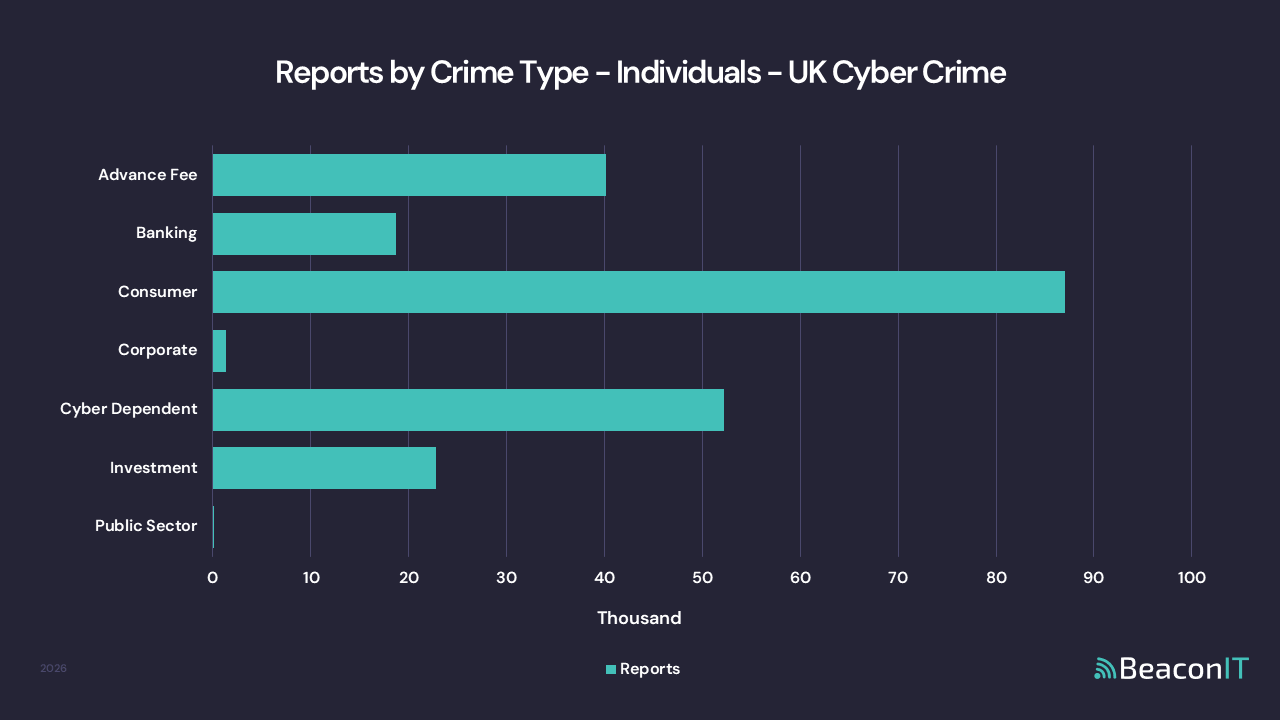

By report volume

| Crime Type | Reports | % |

| Advance Fee | 40.2k | 18.1% |

| Banking | 18.7k | 8.4% |

| Consumer | 87k | 39.1% |

| Corporate | 1.3k | 0.6% |

| Cyber Dependent | 52.2k | 23.5% |

| Investment | 22.8k | 10.2% |

| Public Sector | 108 | 0.0% |

Insights for Individual Report Volume

- Consumer fraud dominates individual reporting - Nearly four in ten reports (39.1%) relate to consumer fraud, reinforcing that everyday transactions (Shopping, rentals, tickets, dating) remain the most common entry point for cyber-enabled crime against individuals.

- Cyber-dependent crime is widespread but often invisible in value terms - Over 23% of individual reports involve hacking, malware, or account compromise, highlighting how frequently personal accounts are breached even when immediate financial loss is limited.

- Advance fee fraud remains a high-volume tactic - Advance fee scams account for 18.1% of reports, showing that classic fraud techniques continue to scale effectively when combined with digital channels.

- Investment fraud is relatively rare but not insignificant - Just 10.2% of reports relate to investment fraud, yet this category consistently signals higher-risk outcomes compared to most other individual crime types.

- Banking fraud appears lower in volume than expected - With 8.4% of reports, banking fraud is less common than consumer or cyber-dependent crime, suggesting controls and awareness may be limiting frequency, though not necessarily impact.

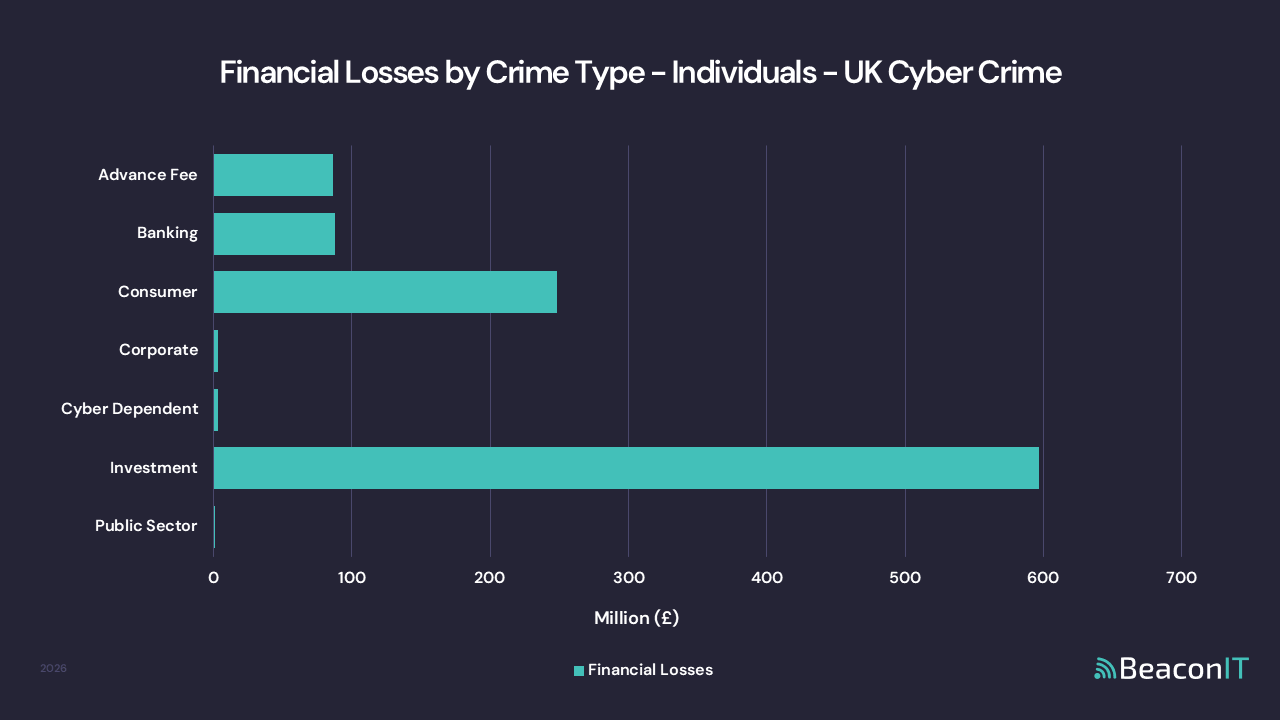

By financial losses

| Crime Type | Losses | % | Loss/Report |

| Advance Fee | £86.1m | 8.4% | £2.1k |

| Banking | £87.6m | 8.5% | £4.7k |

| Consumer | £248.3m | 24.2% | £2.9k |

| Corporate | £3m | 0.3% | £2.2k |

| Cyber Dependent | £3.3m | 0.3% | £64 |

| Investment | £597m | 58.2% | £26.2k |

| Public Sector | £1m | 0.1% | £9.7k |

Insights for Individual Financial Losses

- Investment fraud is the primary driver of individual financial harm - Despite accounting for only one in ten reports, investment fraud represents 58.2% of all individual financial losses, making it the single most damaging threat to individuals.

- Average loss reveals true exposure - The average investment fraud loss of £26.2k per individual dwarfs all other categories, confirming that these incidents are fewer in number but far more severe when they succeed.

- Consumer fraud causes steady, cumulative damage - While the average loss per report is relatively low (£2.9k), consumer fraud still accounts for 24.2% of total individual losses, driven by sheer volume rather than severity.

- Cyber-dependent crime is rarely financially catastrophic on its own - With an average loss of just £64 per report, cyber-dependent incidents tend to act as enablers, setting the stage for later fraud rather than causing direct losses themselves.

- Banking fraud sits in the middle ground - Banking fraud contributes 8.5% of losses, with a higher average loss than consumer fraud (£4.7k), indicating fewer incidents but more direct financial consequences when they occur.

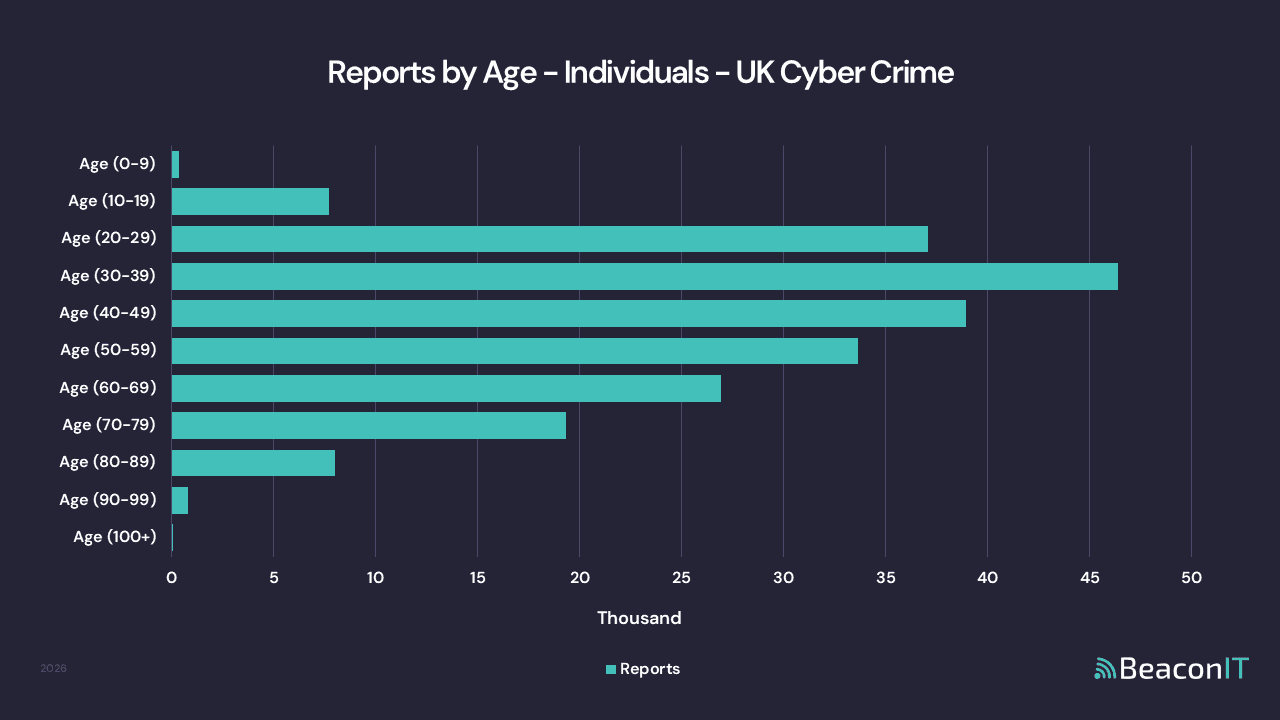

Age Demographics

By report volume

| Age | Reports | % |

| Age (0-9) | 360 | 0.2% |

| Age (10-19) | 7.7k | 3.5% |

| Age (20-29) | 37k | 16.7% |

| Age (30-39) | 46.4k | 20.9% |

| Age (40-49) | 38.9k | 17.5% |

| Age (50-59) | 33.7k | 15.1% |

| Age (60-69) | 26.9k | 12.1% |

| Age (70-79) | 19.3k | 8.7% |

| Age (80-89) | 8k | 3.6% |

| Age (90-99) | 787 | 0.4% |

| Age (100+) | 17 | 0.0% |

Insights for Report Volume via Age Demographics

- Cyber crime reporting peaks in working-age groups - People aged 30–39 report the highest number of incidents (20.9%), closely followed by those aged 40–49 and 20–29, reflecting greater digital exposure rather than greater naivety.

- Risk tracks online activity, not age - The concentration of reports between ages 20–59 suggests cyber crime follows where online banking, shopping, work platforms, and digital services are most heavily used.

- Younger users are not immune, just impacted differently - While under-20s account for a small share of reports, incidents still occur, often tied to account compromise, gaming platforms, or social media misuse.

- Reporting drops with age, but exposure doesn’t disappear - From age 60 onwards, report volumes decline steadily, not because risk vanishes, but likely due to lower reporting rates or different digital habits.

- Extreme age groups are under-represented, not unaffected - Very low reporting among the oldest age brackets should not be read as safety, but as limited engagement with reporting channels.

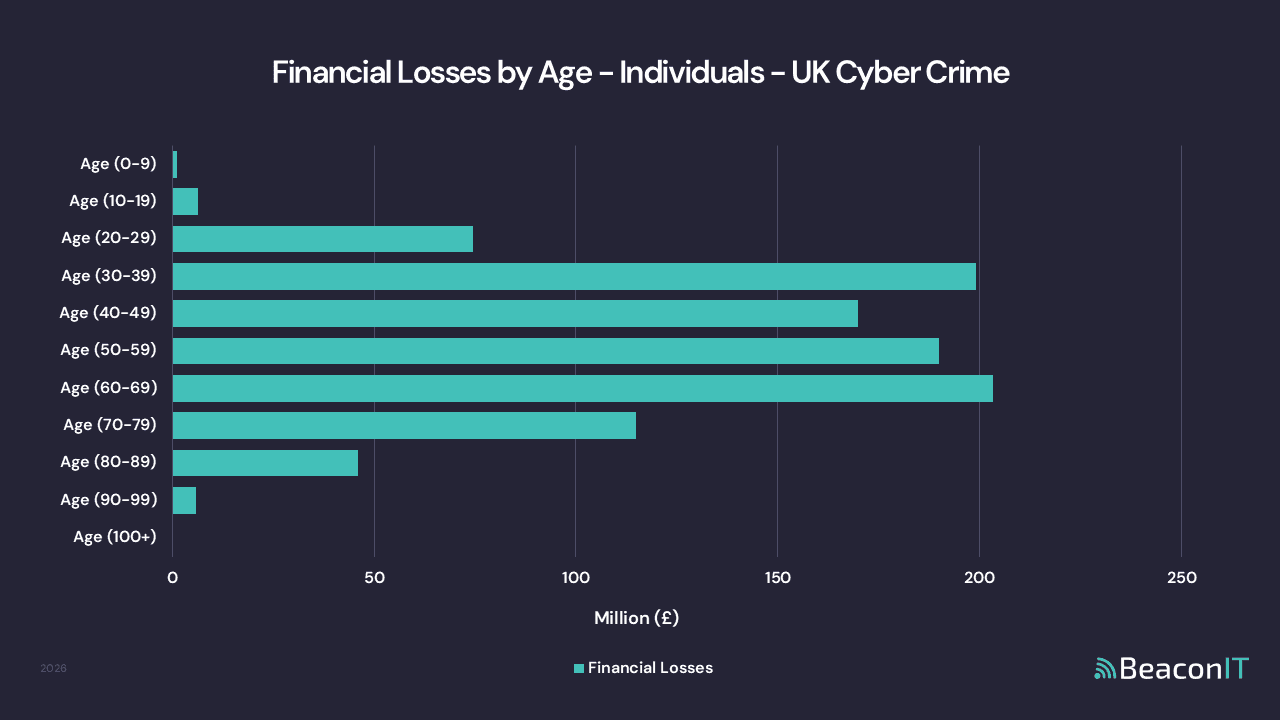

By financial losses

| Age | Losses | % | Loss/Report |

| Age (0-9) | £1.3m | 0.1% | £3.5k |

| Age (10-19) | £6.3m | 0.6% | £816 |

| Age (20-29) | £74.5m | 7.3% | £2k |

| Age (30-39) | £199.1m | 19.4% | £4.3k |

| Age (40-49) | £169.9m | 16.6% | £4.4k |

| Age (50-59) | £189.9m | 18.5% | £5.6k |

| Age (60-69) | £203.3m | 19.8% | £7.5k |

| Age (70-79) | £114.9m | 11.2% | £5.9k |

| Age (80-89) | £46.1m | 4.5% | £5.7k |

| Age (90-99) | £5.8m | 0.6% | £7.4k |

| Age (100+) | £77.5k | 0.0% | £4.6k |

Insights for Financial Losses via Age Demographics

- Financial impact increases significantly with age - Average losses rise steadily from middle age onwards, peaking among 60–69 year olds, who account for £203.3m (19.8%) of total losses.

- Older victims lose more per incident, not because they’re targeted more often, but because attacks escalate further - Higher average losses (£7.5k for 60–69, £7.4k for 90–99) suggest frauds against older individuals are more likely to involve investment or long-term manipulation.

- Middle-aged groups absorb the greatest total damage - Ages 30–59 collectively account for the largest share of total financial losses, reflecting a combination of higher reporting volume and meaningful loss per case.

- Younger age groups experience frequent incidents with limited financial harm - Under-30s show relatively high report volumes but low average losses, indicating early-stage fraud attempts or account compromise rather than fully realised financial scams.

- Very elderly victims face disproportionate loss severity - Although report numbers are low among those aged 80+, average losses remain high, reinforcing the risk of trust-based or prolonged fraud where recovery is difficult.

UK Cyber Crime Statistics for Organisations

Crime Types

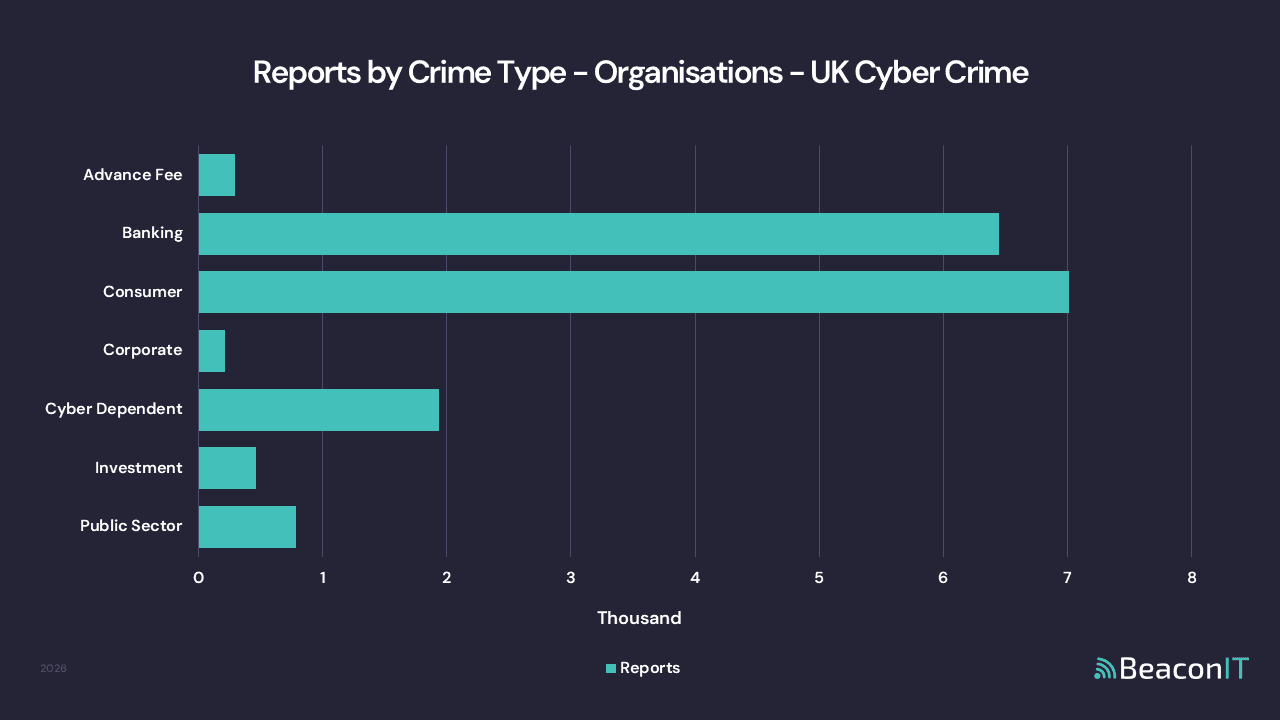

By report volume

| Crime Type | Reports | % |

| Advance Fee | 293 | 1.7% |

| Banking | 6.4k | 37.6% |

| Consumer | 7k | 40.9% |

| Corporate | 214 | 1.2% |

| Cyber Dependent | 1.9k | 11.3% |

| Investment | 463 | 2.7% |

| Public Sector | 784 | 4.6% |

Insights for Organisational Report Volume

- Organisations report far fewer incidents, but face higher exposure per event - Just 7.2% of total reports come from organisations, yet these incidents consistently result in significantly higher losses when compared to individuals.

- Consumer and banking fraud dominate organisational reporting - Together, these two categories account for nearly 80% of organisational reports, highlighting how payment processes, suppliers, and invoices remain primary attack vectors.

- Cyber-dependent crime is less common but still material - At 11.3% of reports, hacking and malware incidents are less frequent than fraud, but often act as gateways to more severe financial exploitation.

- Investment fraud is rare but signals extreme risk - Only 2.7% of organisational reports relate to investment fraud, yet this small subset consistently produces the most damaging outcomes.

- Public sector reporting is comparatively higher than expected - Public sector bodies account for 4.6% of organisational reports, reflecting increased scrutiny and mandatory reporting rather than lower resilience elsewhere.

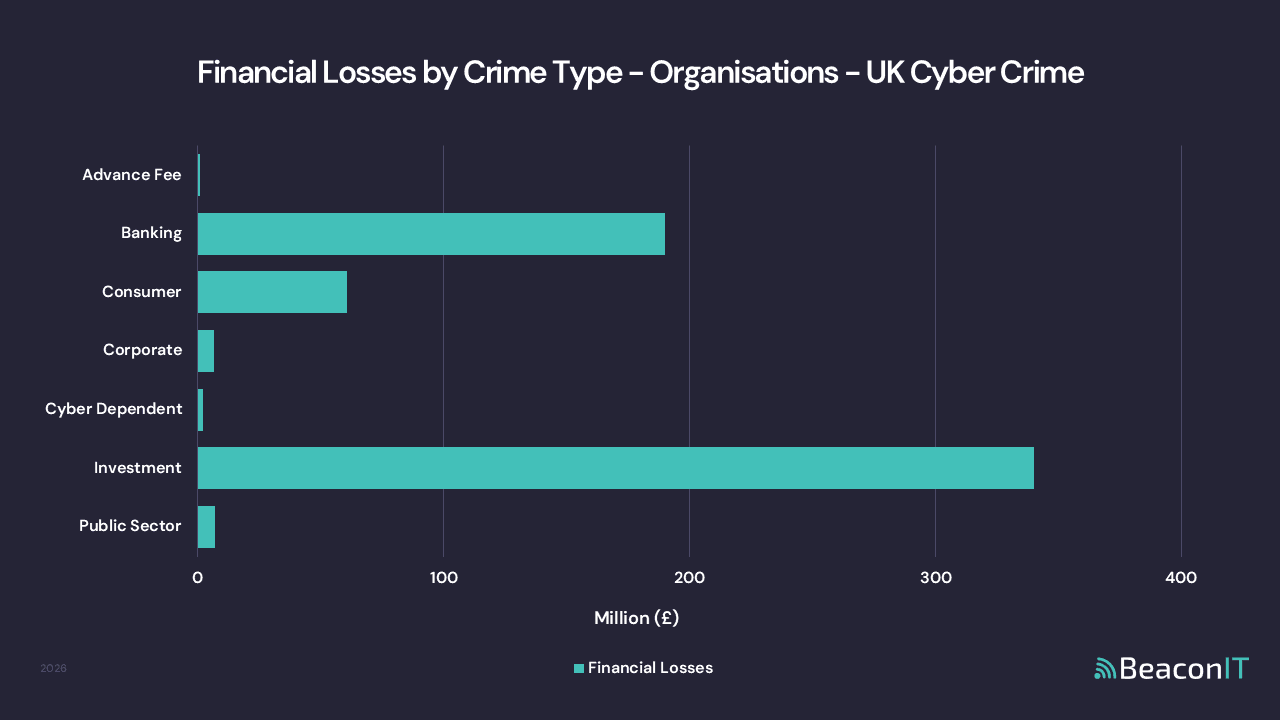

By financial losses

| Crime Type | Losses | % | Loss/Report |

| Advance Fee | £862k | 0.1% | £2.9k |

| Banking | £190m | 31.3% | £29.4k |

| Consumer | £60.6m | 10.0% | £8.6k |

| Corporate | £6.6m | 1.1% | £30.9k |

| Cyber Dependent | £2.2m | 0.4% | £1.2k |

| Investment | £340.1m | 56.0% | £734.6k |

| Public Sector | £7.1m | 1.2% | £9k |

Insights for Organisational Financial Losses

- A small number of incidents cause catastrophic losses - Investment fraud accounts for 56.0% of all organisational losses, despite representing fewer than 500 reports nationally.

- Average losses per incident are dramatically higher than for individuals - At £35.4k per report, organisational incidents carry nearly eight times the financial impact of individual cases.

- Investment fraud losses are commercially existential - An average loss of £734.6k per incident highlights how a single successful fraud can materially threaten business continuity.

- Banking fraud is both frequent and costly - Accounting for 31.3% of losses, banking-related incidents combine high volume with meaningful financial impact (£29.4k average loss).

- Cyber-dependent crime rarely causes direct financial loss but remains a critical enabler - With average losses of just £1.2k, these incidents often act as precursors to later fraud rather than the main financial event.

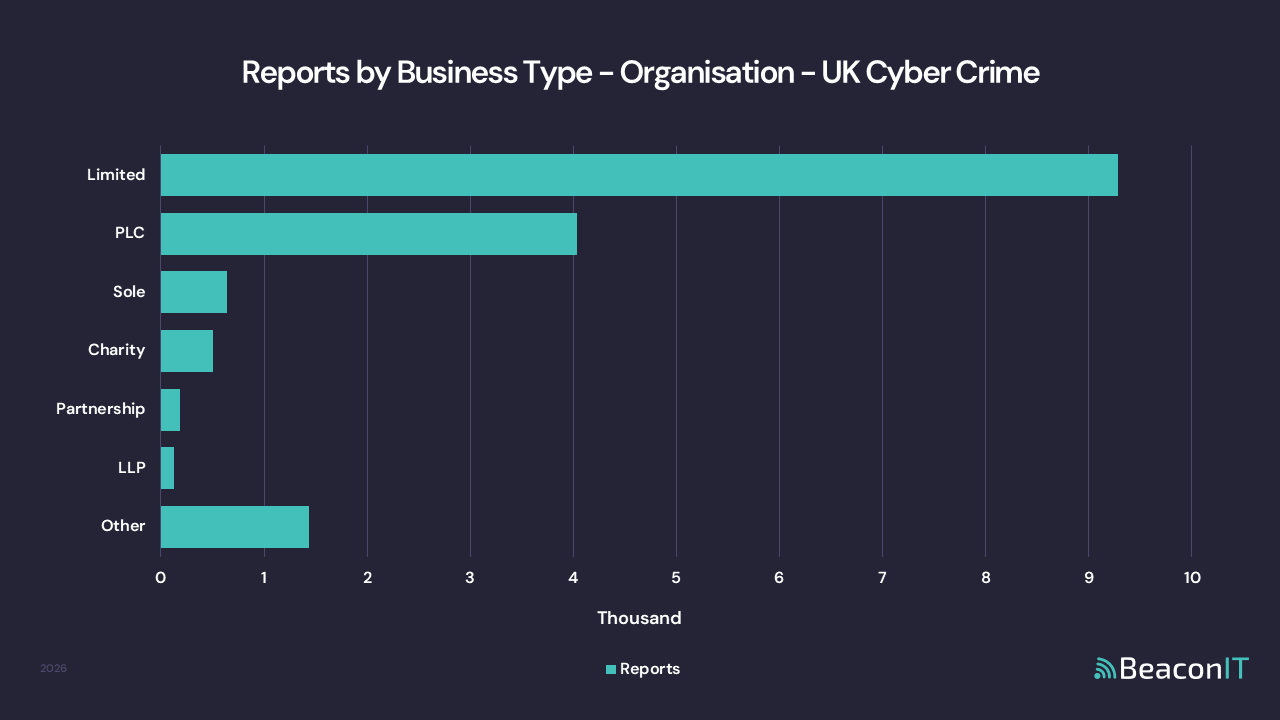

Business Types

By report volume

| Business Type | Reports | % |

| Limited | 9.3k | 54.1% |

| PLC | 4k | 23.5% |

| Sole | 640 | 3.7% |

| Charity | 501 | 2.9% |

| Partnership | 187 | 1.1% |

| LLP | 126 | 0.7% |

| Other | 1.4k | 8.4% |

Insights for Organisational Report Volume via Business Types

- Limited companies account for the majority of reported incidents - Over half of all organisational reports (54.1%) come from limited companies, reflecting both their prevalence among UK businesses and their exposure to digital payment systems, suppliers, and online services.

- PLCs report fewer incidents, but still represent a sizeable share - Public limited companies account for 23.5% of reports, suggesting stronger controls may reduce frequency, though not eliminate risk.

- Smaller entities report far fewer incidents, likely due to under-reporting - Sole traders, charities, partnerships, and LLPs collectively make up a small proportion of reports, which may reflect limited reporting capacity rather than lower exposure.

- LLPs appear least frequently in reports - With just 0.7% of reported incidents, LLPs may underestimate their exposure or delay reporting, particularly where incidents feel ambiguous or reputationally sensitive.

- “Other” business types show fragmented but non-trivial reporting - The 8.4% attributed to other structures highlights that cyber crime does not discriminate by legal form, only by opportunity.

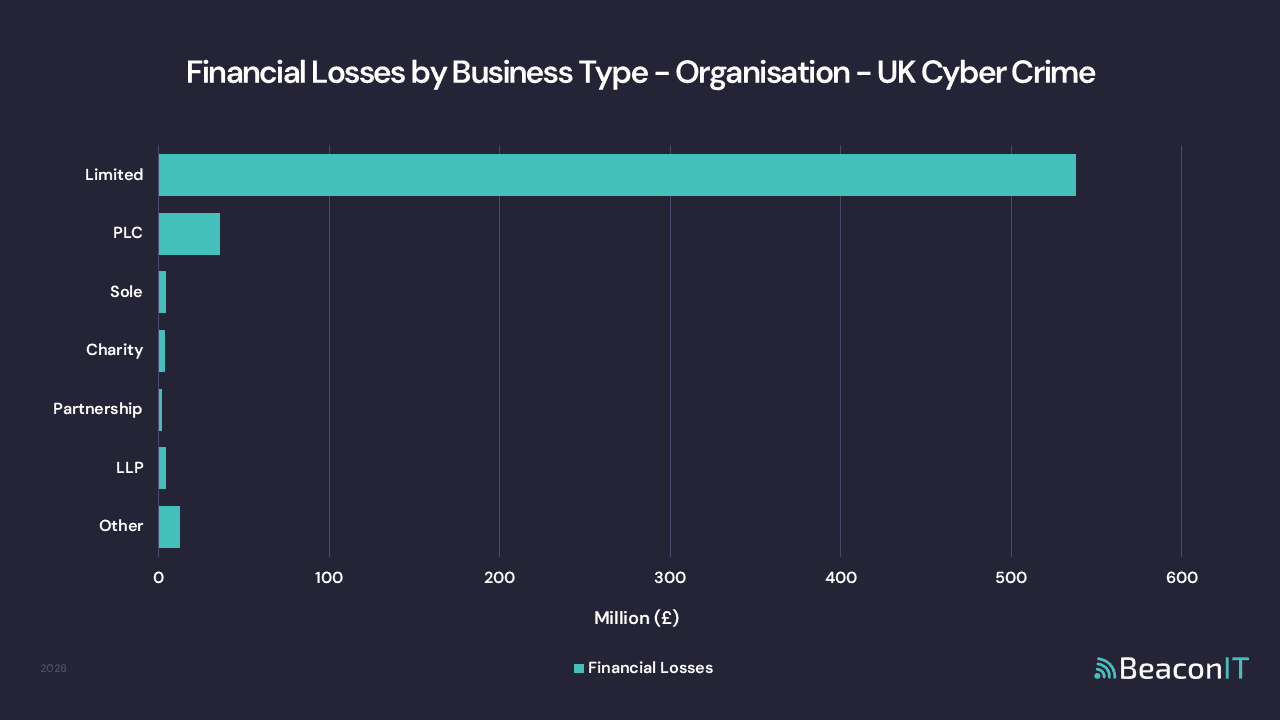

By financial losses

| Business Type | Losses | % | Loss/Report |

| Limited | £538m | 88.6% | £57.9k |

| PLC | £35.7m | 5.9% | £8.8k |

| Sole | £4.3m | 0.7% | £6.8k |

| Charity | £3.7m | 0.6% | £7.4k |

| Partnership | £2.2m | 0.4% | £11.6k |

| LLP | £4.4m | 0.7% | £34.9k |

| Other | £12.6m | 2.1% | £8.8k |

Insights for Organisational Financial Losses via Business Types

- Limited companies absorb the overwhelming majority of financial losses - Limited companies account for £538m (88.6%) of all organisational losses, making them the primary financial casualty of cyber-enabled crime in the UK.

- Average loss per incident varies dramatically by business type - LLPs experience an average loss of £34.9k per report, significantly higher than most other structures, despite low reporting volume.

- PLCs lose less per incident, but at meaningful scale - With an average loss of £8.8k, PLCs appear more resilient per event, though their total losses (£35.7m) remain substantial due to scale.

- Smaller organisations suffer proportionally higher impact - Charities (£7.4k) and sole traders (£6.8k) report lower absolute losses, but these figures often represent a far greater proportion of operating income.

- Business structure influences loss severity, not likelihood of attack - The variation in average loss suggests that governance, controls, and response capability matter more than organisational size or legal form.

About The Data - UK Cyber Crime Statistics

Based on a rolling 12 months of data from Report Fraud.

The UK cyber crime statistics data is extracted from the NFIB Fraud and Cyber Crime dashboard between 01/01/2025 and 31/12/2025.

Data from the regions is produced from the following police forces:

London: City of London, Metropolitan; South East: Hampshire, Surrey, Sussex, Thames Valley; South West: Avon & Somerset, Devon & Cornwall, Dorset, Gloucestershire, Wilshire; North West: Cheshire, Cumbria, Greater Manchester, Lancashire, Merseyside, North Wales; North East: Cleveland, Durham, Northumbria; East: Bedfordshire, Cambridgeshire, Essex, Hertfordshire, Kent, Norfolk, Suffolk; East Midlands: Derbyshire, Leicestershire, Lincolnshire, Northamptonshire, Nottinghamshire; West Midlands: Staffordshire, Warwickshire, West Mercia, West Midlands; Yorkshire & Humber: Humberside, North Yorkshire, South Yorkshire, West Yorkshire; Scotland: Police Scotland; Wales: Dyfed Powys, Gwent, South Wales; Northern Ireland: PSNI.

Only 'cyber-enabled' fraud and cyber crime offences amounting to a crime under the Home Office Crime Recording rules are included.

Cyber-enabled crimes are traditional crimes, which can be increased in their scale or reach by use of computers, computer networks or other forms of IT.

Information reports and crimes reported directly from partner agencies and industry are not included at this time and will account for differences to Office for National Statistics figures for fraud offences in the same period.

For more information relating to different types of fraud and cyber crime please see the A-Z of fraud section on the Report Fraud website.

Limitations

UK cyber crime statistics data is based on victim selection during the reporting process and this has not been verified.

Losses are based on loss amounts as reported in Report Fraud recorded crimes and these have not been verified. Where possible, efforts have been made to review losses reported in excess of £500k but further investigation may be required to determine if loss amounts are a true reflection of the financial impact of the reported crime.

Extreme outliers have been removed to limit data skew.

Crime Types

Below provides a bit more detail about which crime codes fall under which crime type:

Advance fee fraud

- NFIB1A - “419” Advance Fee Fraud

- NFIB1H - Other Advance Fee Frauds

- NFIB3E - Computer Software Service Fraud

- NFIB90 - None of the Above (Courier Fraud)

Banking fraud

- NFIB1C - Counterfeit Cashiers Cheques

- NFIB5A - Cheque, Plastic Card and Online Bank Accounts (not PSP)

- NFIB5B - Application Fraud (excluding Mortgages)

- NFIB5D - Mandate Fraud

- NFIB90 - None of the Above (Courier Fraud)

Consumer fraud

- NFIB1D - Dating Scam

- NFIB1G - Rental Fraud

- NFIB3A - Online Shopping and Auctions

- NFIB3D - Other Consumer Non Investment Fraud

- NFIB3F - Ticket Fraud

Corporate fraud

- NFIB4A - Charity Fraud

- NFIB6B - Insurance Broker Fraud

- NFIB7 - Telecom Industry Fraud (Misuse of Contracts)

- NFIB9 - Business Trading Fraud

Cyber-dependent crime

- NFIB50A - Computer Virus / Malware / Spyware

- NFIB51A - Denial of Service Attack

- NFIB51B - Denial of Service Attack Extortion

- NFIB52A - Hacking – Server

- NFIB52B - Hacking – Personal

- NFIB52C - Hacking – Social Media and Email

- NFIB52D - Hacking – PBX / Dial Through

- NFIB52E - Hacking Extortion

Investment fraud

- NFIB2A - Share Sales or Boiler Room Fraud

- NFIB2B - Pyramid or Ponzi Schemes

- NFIB2E - Other Financial Investment

Public sector fraud

- NFIB4B - Fraudulent Applications for Grants from Charities

- NFIB12 - Passport Application Fraud

- NFIB13 - Department of Works and Pensions (DWP) Fraud

- NFIB14 - Fraudulent Applications for Grants from Government Funded Organisations

- NFIB15 - HM Revenue & Customs Fraud (HMRC)

- NFIB20A - DVLA Driving Licence Application Fraud

Regional Breakdown

Below is a list of regions that our cyber crime research is broken down into:

- London

- South East

- South West

- North West

- North East

- East

- East Midlands

- West Midlands

- Yorkshire & Humber

- Scotland

- Wales

- Northern Ireland

Further Reading

For more information about UK cyber crime statistics, take a look at the following sources: